help i haven't filed taxes in 5 years

Then start working your way back to 2014. Ad Find Out Why Precision Tax Gets The Highest Customer Ratings For IRS Tax Help.

How To File Your Taxes In 5 Simple Steps Ramsey

The worst that could happen is that you could go to prison for tax evasion which can be as much as five years and 250000 in fines.

. Will I get in trouble if I havent filed taxes in years. The IRS recognizes several crimes related to evading the assessment and payment of. 415 16 votes If youre required to file a tax return and you dont file you will have committed a crime.

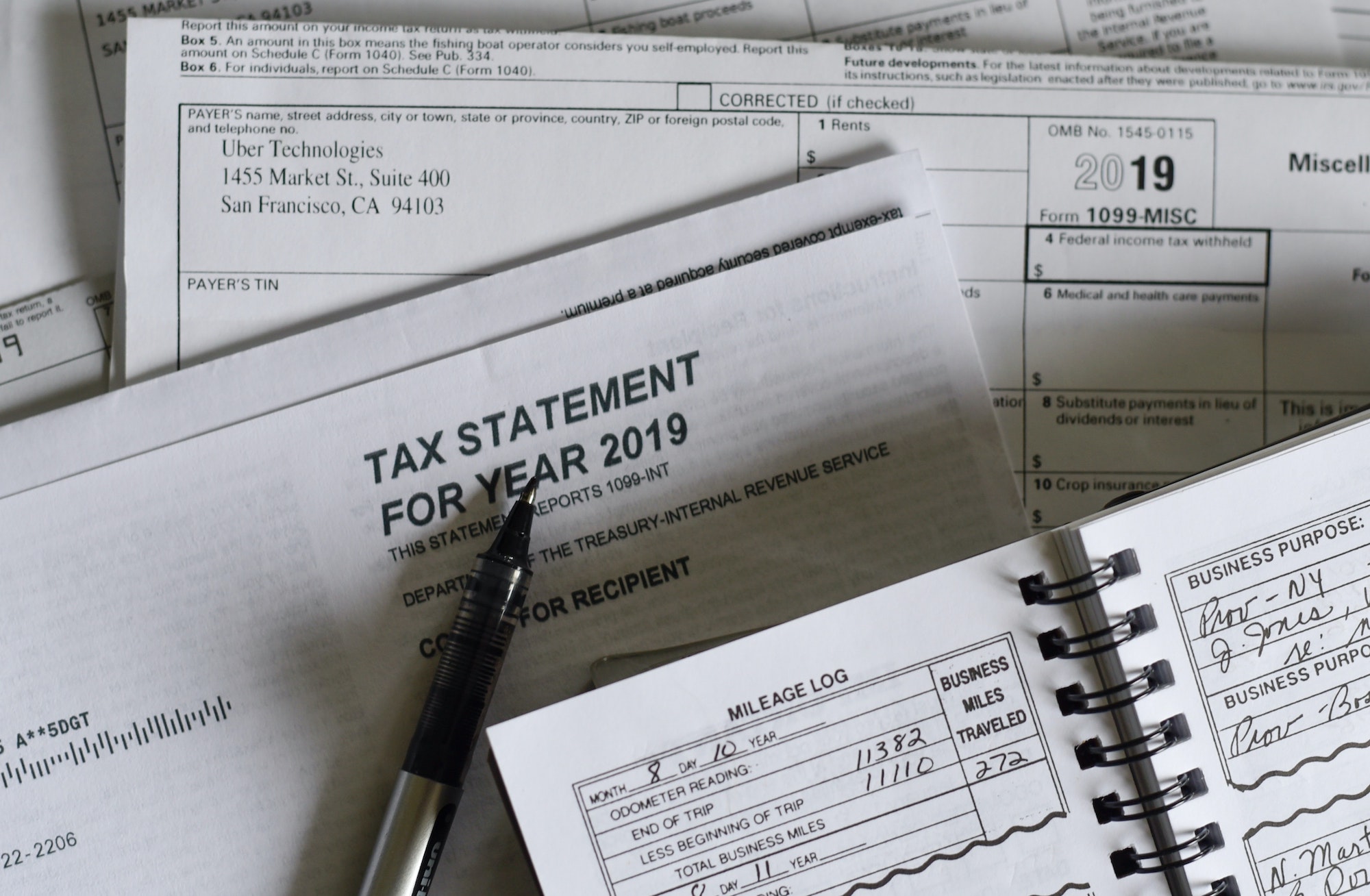

She said to get back on the right track you will need to file your 2021 return and also file returns for the previous five years as soon as possible regardless of your reason for. Contact the IRS by filling out Form 4506-T Request for Transcript of Tax Return. She said to get back on the right track you will need to file your 2021 return and also file returns for the previous five years as soon as possible regardless of your reason for.

This penalty is 5 per month for each month you havent filed up to a. The IRS recognizes several crimes related to evading the assessment and payment of taxes. If you fail to file your taxes youll be assessed a failure to file penalty.

As we have previously recommended if you havent filed taxes in a long time you should consider two paths. What if I havent filed taxes in 6 years. You have three years to file or else you forfeit your refund so the.

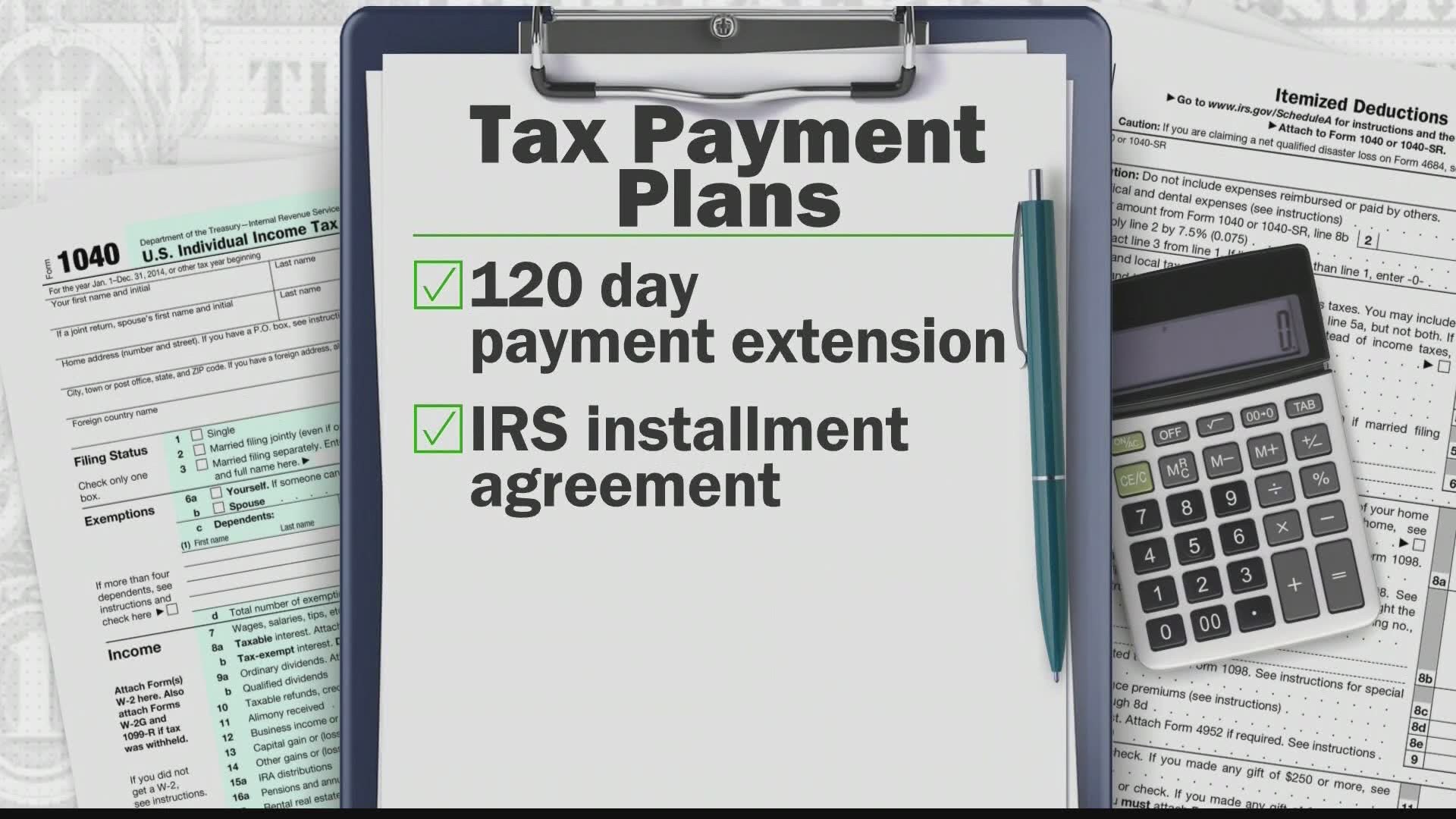

Havent Filed Taxes in 5 Years If You Are Due a Refund Its too late to claim your refund for returns due more than three years ago. Underpayment penalty 05. Ad Havent Filed Your Taxes In.

For each return that is more than 60 days past its due date they will assess a 135 minimum failure to file penalty. Confirm that the IRS is looking for only six years of returns. Some tax software products offer prior-year preparation but youll have to print.

Failure to file penalty 5 of unpaid tax per month. Call the IRS or your tax pro can use a dedicated hotline to confirm the unfiled years. Contact the CRA.

Input 0 or didnt file for your prior-year AGI. Get Your Act Together What you need to do is rectify the. What happens if you havent filed taxes in 7 years.

If youre late on filing youll almost always have to contend with these two penalties. 1 day agoSix child tax credit payments went out in 2021 and the rest of the money will come with your tax refund this year after you file your taxes. The criminal penalties include up to one year in prison for each year you.

Failure to file or failure to pay tax could also be a crime. The failure to file penalty also known as the delinquency. If you havent filed your federal income tax return for this year or for previous years you should file your return as soon as possible regardless of your reason for not filing.

However you can still claim your refund for any returns. The IRS doesnt pay old refunds. Using the form you can ask that the IRS send you W-2s 1099s and 1098s for the relevant tax.

IRS Policy Statement 5-133 Delinquent Returns Enforcement of Filing Requirements provides a general rule that taxpayers must file six years. For taxpayers who havent filed in previous years the IRS has current and prior year tax forms and instructions available on the IRSgov Forms and Publications page or by calling toll-free 800. Failure to file or failure to pay tax could also be a crime.

Filing six years 2014 to 2019 to get into full compliance or four. Any help would be very much appreciated I just read that after 3 years of not filing your taxes the government doesnt owe you your refund anymore so I want to get what I still can before its.

What Really Happens If You Don T File Your Taxes

2021 Tax Returns What S New On The 1040 Form This Year Kiplinger

Here S What Happens If You Don T File Your Taxes Bankrate

2020 Tax Day Five Things To Know Before Midnight Filing Deadline 13wmaz Com

4 Steps If You Haven T Filed Your Taxes In A While Inc Com

:max_bytes(150000):strip_icc()/GettyImages-92125643-b5c3bc0656ab41e48c59795ef5a318bd.jpg)

Tax Refund Missing Reasons You Never Received One

Haven T Filed Your Tax Yet Here S What You Need To Know Youtube

Can I Get A Stimulus Check Without Filing Taxes Saverlife

Don T Freak If You Haven T Filed Your Taxes Yet

Can You Still Get The Third Stimulus Check If You Haven T Filed Your 2020 Taxes The Us Sun

How To File Taxes If You Haven T Filed In Years Youtube

How To Fill Out The Irs Non Filer Form Get It Back

I Haven T Filed Taxes In 5 Years How Do I Start

Still Haven T Done Your Taxes How To Get Help

Haven T Filed Your Taxes Here S What You Need To Know Youtube

Haven T Filed Taxes In Years What You Should Do Youtube

Get Back On Track With The Irs When You Haven T Filed H R Block

Haven T Filed Taxes In 10 Years Don T Know Where To Start R Legaladvice